This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 75,000 other investors today.

To investors,

The biggest recent knock against Bitcoin from the peanut gallery has been something along the lines of “yeah, but Bitcoin is still down almost 50% from the all-time high.” This is not only a lazy argument intellectually, but it also is highly misleading when presented without context.

First, why are people yelling about this on Twitter and television? The simple answer is because Bitcoin has violated the mainstream narrative. It didn’t die in 2018, although most of the talking heads were calling for the digital currency’s death. If that wasn’t bad enough, Bitcoin and crypto has served as the best performing asset class this year. The pandemic, economic shock, and subsequent intervention by the Federal Reserve has created a situation that resulted in a 50%+ increase in Bitcoin’s price year-to-date.

But remember, you wouldn’t know it by reading Wall Street / finance talking head Twitter or watching television. They’re still screaming “yeah, but Bitcoin is still down almost 50% from the all-time high.”

What these people are referring to is the spot market price for Bitcoin. In 2017, we saw Bitcoin rise from around $1,000 to a high of $20,000 in the calendar year. The asset went from $10,000 to $20,000 in a mere 18 days. It was sitting around $19,000 for about 72 hours, before falling almost 85% over the next 12 months to nearly $3,000. Finally, Bitcoin was above $10,000 for less than 60 consecutive days in December 2017-January 2018.

This context is really important because it shows that the end of 2017, and into the beginning of 2018, was a classic blow-off top in a market that had reached an unsustainable level of frothiness. Any sophisticated investor would heavily discount this data when looking at historical price analysis, because it doesn’t serve as a good representation of where Bitcoin was being priced.

Here are two other data points to evaluate that I believe will serve as better indicators of Bitcoin’s price over the long-run:

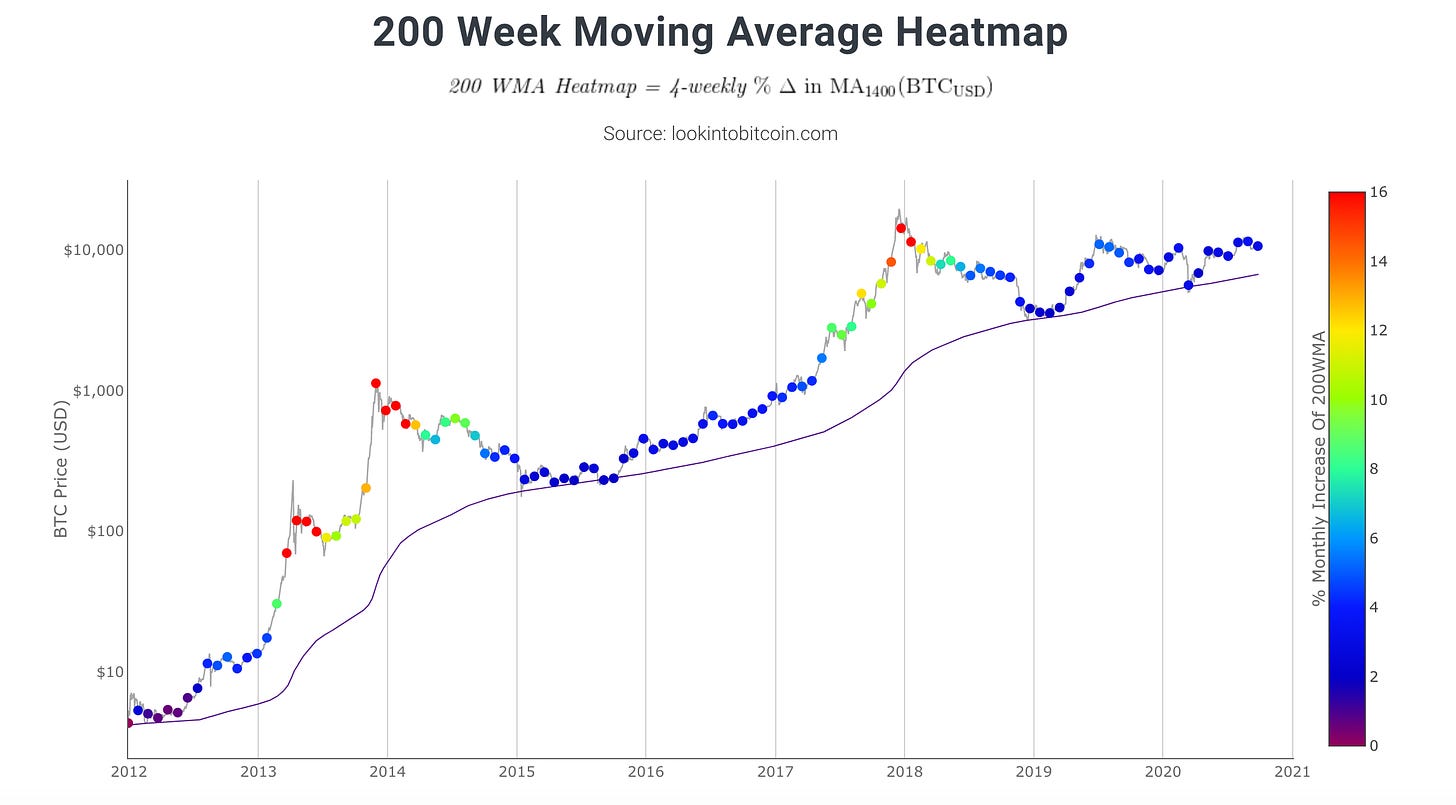

Bitcoin’s 200-week moving average

Bitcoin’s number of consecutive days over $10,000

Let’s look at the 200-week moving average first.

As you can see in this visual representation, Bitcoin’s price has never fallen below the 200-week moving average. It rises significantly above the average in the bull markets and has historically bounced off the 200-week moving average in bear markets. Additionally, according to the 200-week moving average of Bitcoin, the asset is currently sitting at an all-time high in price.

Next, let’s look at the number of consecutive days that Bitcoin’s price is above $10,000.

The previous all-time high was 62 consecutive days back in 2017-2018, but as of last night, Bitcoin has established a new all-time high in consecutive days above $10,000. Shout out to Zack Voell of Coindesk for pointing this out.

So wait a minute? The 200-week moving average and the consecutive days above $10,000 are both at all-time highs, but the talking heads are still screaming about $20,000?

Their argument makes for great headlines. It doesn’t tell the full story though. The spot price is worth being aware of, but the 200-week moving average and consecutive days above $10,000 are much better metrics to watch in my opinion. They give you an idea of how strong the Bitcoin price is over a period of time. It helps to smooth over the outlier data and show the general and relative trend in price.

Remember, look at that 200-week moving average. It continues to go up-and-to-the-right in a fairly compelling manner. This is exactly what long-term holders (and investors) want to see. I don’t care about the short-term price movements. I care A LOT about the long-term price movements. And so far, so good.

As I continue to talk about, there is an incredible amount of misinformation being thrown around in the Bitcoin world. The narratives that get laid out can be quite misleading. Stay focused on long-term trends and keep a low time preference. This advantage of having a long time horizon will ensure that you can benefit from one of the greatest wealth transfers in human history.

Have a great start to your week and don’t forget, Bitcoin is sitting at an all-time high in the metrics that actually matter :)

-Pomp

This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 75,000 other investors today.

THE RUNDOWN:

Vulture Investor Feasts on Crypto Whales Seeking Quick Exits: When big investors commonly referred to as whales need to quickly or quietly get out of the cryptocurrency world, they often turn to Brian Estes. Estes, 52, runs Off The Chain Capital LLC, a nearly $40 million fund that specializes in buying digital assets from people strapped for cash due to divorce, loss of income or other unforeseen circumstances. The Orlando, Florida-based firm typically picks up assets at more than a 50% discount, Estes said. Read more.

EU Plans to Regulate Cryptocurrencies in Digital Finance Push: The European Union is taking a major step to regulate crypto assets in the bloc, seeking to protect its financial markets without depriving citizens and companies of the new technologies. Under the initiative unveiled on Thursday the EU’s executive arm seeks to establish clear ground rules for cryptocurrencies, which often aren’t captured by traditional rules and can leave investors without protection. Read more.

Jack Dorsey Details Twitter's Blockchain Strategy at Oslo Freedom Forum: When Twitter and Square CEO Jack Dorsey spoke at the virtual Oslo Freedom Forum 2020 on Friday, he said blockchain technology is the future of Twitter. “Blockchain and bitcoin point to a future, point to a world, where content exists forever,” Dorsey said. “We’re not in the content hosting business anymore, we’re in the discovery business.” Read more.

Hong Kong Reportedly Picks ConsenSys for Digital Currency Pilot Project: Ethereum workshop ConsenSys said it has been chosen by the Hong Kong Monetary Authority (HKMA) to assist in Hong Kong and Thailand’s cross-border central bank digital currency (CBDC) pilot. ConsenSys said in a Friday announcement it will "work on the second implementation stage" of those countries' Project Inthanon-LionRock CBDC alongside consultancy PricewaterhouseCoopers and Forms, a Hong Kong fintech.Read more.

Ant Launches Business Trade Blockchain in Run-Up to $35B IPO: Ant Group has launched a cross-border trading blockchain platform as it prepares for what could be the largest stock market flotation of all time. Ant said Friday that its new trade platform, called "Trusple," will make it easier for small and medium-sized enterprises (SMEs) to sell their wares to clients overseas. Built on AntChain, Trusple automates key aspects of the payments process, such as order placement and tax liabilities. Read more.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Amanda Agati is the Chief Investment Strategist for PNC Financial Services Group. In this role, Amanda leads the team which establishes overall strategic and tactical asset allocation guidance of client portfolios, oversees the evolution of investment processes, provides thought leadership on key investment issues, and authors numerous publications.

In this conversation, Amanda and I discuss:

COVID-19

The Federal Reserve

Inflation

The Presidential election

Trade policy

Whether 60/40 portfolios are dead

Betting odds

Bitcoin

I really enjoyed this conversation with Amanda. Hopefully you enjoy it too.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Athletic Brewing is re-imagining beer for the modern adult. They love beer. But they also love being healthy, active and at their best. The non-alcoholic beers are fully flavored, clean ingredient, and a fraction of the calories of full strength beer - they fit in any occasion. Check out www.athleticbrewing.com for more details and free shipping nationwide.

Choice is a new self-directed IRA product that allows you to buy Bitcoin with tax-advantaged dollars, while still holding your private keys. You can go to retirewithchoice.com/pomp to sign up today.

Unstoppable Domains is working to make the internet operate how it was originally intended, which means anyone can publish anything from anywhere. You can go to unstoppabledomains.com and claim your censorship resistant domain today.

BlockFi provides financial products for crypto investors. Products include high-yield interest accounts, USD loans, and no fee trading. To start earning today visit: http://www.blockfi.com/Pomp

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp2020” when you sign up for one of their metal cards today.

Coinlist — Smart investors know being early is critical to success in crypto. CoinList is where early adopters invest in, earn, and trade the best new crypto assets before they list on other exchanges. Sign up via coinlist.co/pomp and earn $10 in BTC after you trade $100.

If you enjoy reading “The Pomp Letter,” click here to tweet to tell others about it.

Nothing in this email is intended to serve as financial advice. Do your own research.