Today’s letter is brought to you by Domain Money!

Wondering where to go for financial advice? Domain Money makes financial planning simple. No hidden fees and no sales pitches - you get a personalized roadmap to your goals, from dream vacations to retirement.

Flat-fee advisors create a plan tailored to you, with zero pressure to invest. Don’t be like most people who’ve never had a real conversation about their financial plan. Book a free strategy session today here.

While I'm not a Domain Money client and they are paying me, I've seen first hand the value of their service through the free plan they did for one of my brothers.

Yes, I might have an interest in promoting Domain Money, so just like any major financial decision, it's important you understand what the service is and if it's right for you so make sure to see this important disclaimer.

To investors,

Bitcoin has been one of the best performing assets in finance for years. This fact has been great for investors looking to optimize their returns compared to other financial investment opportunities.

But the vast majority of people on the planet are not investors. They are simply people trying to live their life and pursue happiness.

One of the major issues that creates friction for the average citizen is the debasement of their local currency. Given that ~ 50% of Americans have $0 in investment assets, these individuals continue to feel like they can’t get ahead. They are falling further behind. Everything around them is getting more expensive. Eventually they lose hope.

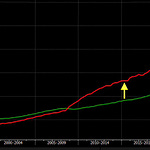

Thankfully, bitcoin can be a solution to the problem. Here is a graphic from Bitcoin Magazine showing the cost in US dollars and bitcoin for the median US home in 2016, 2020, and 2024.

Seeing the median home price in dollars nearly double is painful, but watching the same home price drop to 1/100th in bitcoin terms is incredible. This is the beauty of digital sound money.

With that said, people have become very excited about other crypto projects in the last two or three years. Many of these assets continue to perform well, and we know Wall Street loves volatility, so we shouldn’t be surprised.

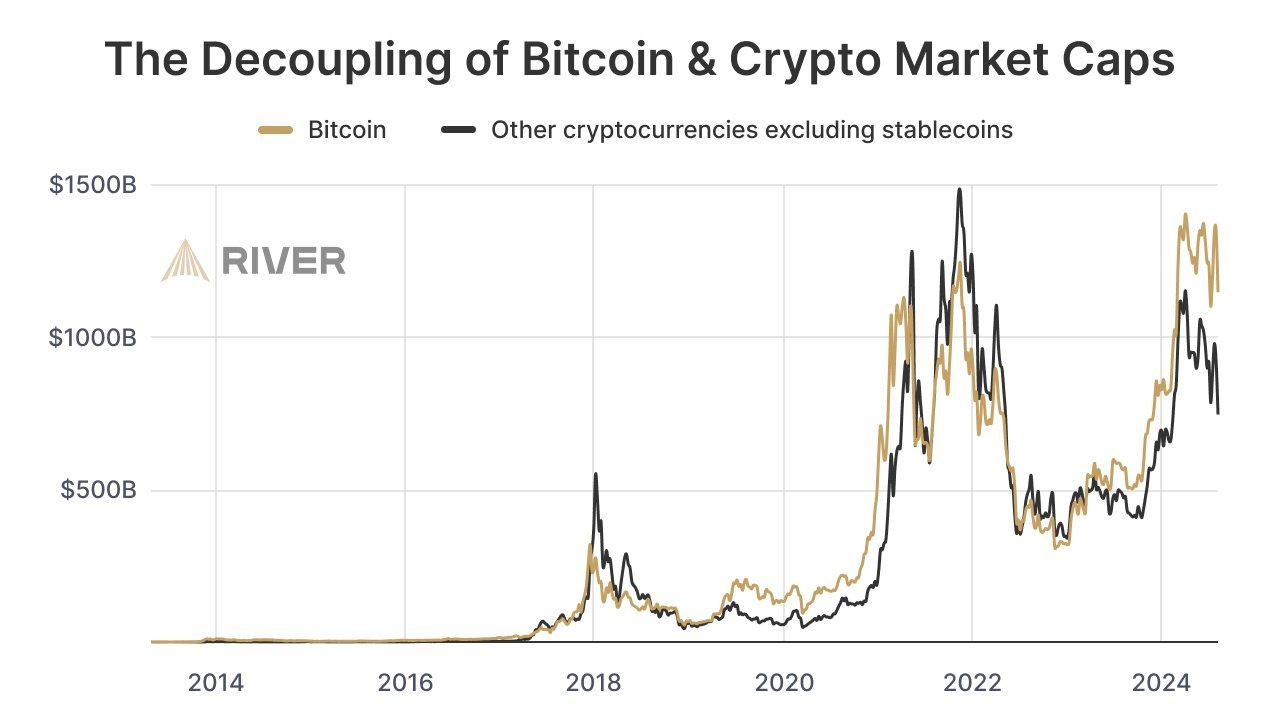

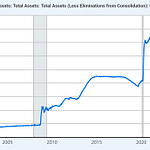

Sam Wouters from River points out that bitcoin’s market cap continues to stand out despite the increasing interest in other assets:

“3 years ago, Bitcoin's market cap was ~$835B. Same for all the crypto stuff without stablecoins. Today, Bitcoin's market cap is up 37% ($1.15T) And the other stuff? -11% (not adjusted for inflation) It’s an insightful statistic to present to people who blindly “diversify”.”

Bitcoin doesn’t operate in a silo though. It is part of a larger financial system now. Both investors and savers have various options of where to store their economic value. Here is a short 1-minute from Tom Crown comparing saving $100 per month in US dollars, gold, and bitcoin.

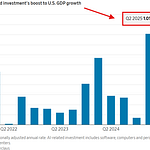

Another way to view a similar analysis is to look at the compound annual growth rates of bitcoin, gold, and the S&P 500.

The bitcoin community is full of various characters. Some of the ideas coming out of the community are correct and many of them are outright ridiculous. One thing that is objectively true — bitcoiners nailed the asset’s ability to protect purchasing power over long periods of time.

It will be hard for sophisticated, institutional investors to ignore these type of dominance in financial markets. More importantly though, the average citizen now has a simple solution to an age-old problem of dollar debasement.

Hope you all have a great start to your week. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

Alessandro Palombo is the Co-Founder of Unbound with a mission to design the future of global citizenship. They are using bitcoin indirect exposure to help you get a Golden Visa in Portugal.

In this conversation, we talk about how it works, risks, requirements, family implications, and the potential of expanding to other cryptos?

Listen on iTunes: Click here

Listen on Spotify: Click here

Overview of Golden Visa with Indirect Bitcoin Exposure

Podcast Sponsors

Gemini is the safe and secure way to trade crypto. Use code Pomp100 and start trading crypto to earn $100 in BTC.

Xapo Bank is the only way to bank with Bitcoin.

CrossFi is the Apple Pay for Crypto. For the first time in history, anyone with a web 3 wallet can spend crypto through a physical or virtual Visa card where Visa is accepted.

Domain Money makes financial planning straightforward and accessible. They tailor plans to your personal priorities and goals, whether it’s buying a house, funding college, or taking that dream vacation.

Meanwhile is the world’s first licensed and regulated life insurance company built for the Bitcoin economy.

iTrustCapital allows you to buy and sell cryptocurrency in a tax-advantaged crypto IRA. Open and fund an account today to receive a $100 USD funding bonus.

ResiClub - Your data-driven gateway to the US housing market.

Professional Capital Management - Anthony Pompliano’s asset management firm is now on Linkedin. Please subscribe by clicking here.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.