This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 50,000 other investors today.

To investors,

It seems that everyone has an opinion when it comes to financial assets and markets. There are two very different groups of people who provide commentary though. One group has significant skin in the game and the other group does not.

The issue historically is that the commentary provided by those without skin in the game has been more widely available than the commentary that originates from the actual market participants. This is all changing with the adoption of social media, email newsletters, blogs, and various other content platforms.

In fact, I anticipate that we will see the individuals who have skin in the game acquire larger audiences than those without skin in the game within the next 12-24 months. While this should be a net positive for content consumers, it doesn't solve the problems that we are facing today.

Currently, there are three types of content producers in the financial industry — journalists, bloggers, and market participants. The journalists investigate, ask questions, interview, report facts, and hold market participants accountable. The bloggers analyze and opine on the market sometimes even without speaking to market participants for their pieces. The market participants are the people who consider their full-time job to be that of an investor, yet create content as an auxiliary activity.

One of the issues with finance information today is that a plethora of bloggers are now masquerading as financial journalists. Many people will associate negative connotations with the term "blogger," but that is not what my intention is. Instead, I am using "blogger" and "journalist" as categorizations for two different types of content production.

A journalist has specific ethics, process, and requirements to meet before publishing an article. A blogger has different ethics, process, and requirements to meet before publishing an article. I'll leave others to debate the merits of which is better.

In an overgeneralization, journalists have historically reported on the facts. What happened? When? Who was involved? What are those people saying? Why is this happening? Bloggers have pursued a different path. They are much more opinionated. Their focus leans toward their opinion on why this happened, and they often try to answer, “what will happen next?” Neither is right or wrong, but there is a clear difference between objective reporting and opinion-based blogging.

This leads us to the infiltration of bloggers in legacy media organizations. The incumbents realized they were losing the battle for attention on the internet, so they sought out those people who were best at capturing and holding attention (ex: clickbait, opinion, etc). Additionally, the bloggers desired legitimization, and they gladly answered the call when the incumbent organizations came calling.

When one of these individuals was hired at a well known publication in 2014, another media company wrote “he brings an altogether different voice: Over-the-top, all-caps headlines, hyperactive tweeting, and outspoken opinions about who is on the right and wrong side of contentious economic debates.” The piece goes on to describe an inherent problem with bringing together bloggers and journalists:

“The Bloomberg Way also insists on ample documentation and sourcing for any assertions or heavy-handed characterizations. "A story is incomplete and untrustworthy when it includes unsupported assertions," Winkler writes. "The best reporters assemble the details, anecdotes, and comments and then let the readers decide who's right, wrong, guilty or innocent.”

The writer then hammers home the point by saying “"If you tried to make [redacted person’s name] follow The Bloomberg Way to the letter, it would destroy what makes him effective as a writer.” The transition from strict, traditional journalism to internet-friendly, blogger-centric coverage is well documented. It is not about one person or one organization. This has played out at almost every publication, while also materially altering the type of content.

This evolution of content on the internet opened the door for financial market participants. They have always understood markets and assets better than anyone, but they previously only had a voice when a journalist or media organization lent a platform to them. The internet now provides the tools for these market participants to communicate directly with the audience and cut out the middle man (ex: media organizations).

This is obviously not exclusive to the finance industry, so why is this important?

There is a big difference in the quality of information being shared by the three groups of content creators that we have identified. Journalists continue to adhere to the highest standards and focus on unbiased reporting. Bloggers and market participants are more opinion-oriented. Sounds good, right?

Wrong. There is one major difference between the bloggers and market participants — skin in the game. The blogging crowd spends their time pontificating on markets and asset prices, but there is no penalty when they are wrong. Market participants stand to lose millions of dollars when their opinions are inaccurate or ill-timed. This difference between bloggers and market participants is one of the most important things a reader needs to identify to ensure they are consuming the highest quality content.

Quite literally, the market participants are not only sharing their opinions, but they are also betting millions of dollars on the idea that they are right. When they are wrong, they lose money. When they are right, they stand to make a lot of money. This idea of content creation by market participants does not come without issue (ex: bias, investors marrying their assets, etc), but I will leave those issues for analysis on another day.

To make my point clear, I will use the coverage of the Bitcoin halving as an example. There were plenty of journalists who merely reported on past halvings and/or compiled commentary from market participants. As expected, the bloggers took a different angle. They continuously shared their personal opinions and analysis about what would happen. The market participants did the exact same thing.

The quality of analysis was quite different though. Most of the "what will happen next"-style content from the bloggers revolved around “the Bitcoin halving is priced in” or “the price will go up or down after the halving.” Their analysis lacked the intellectual rigor needed to make investment decisions. This isn’t a bad thing — the bloggers aren’t investing any money, so it would make sense that they would not need deep analysis.

The market participants were a different story though. Much of their writing included specific aspects that highlight the rigor needed to make an investment decision. They included macro and micro events, an understanding of how the system works holistically, specific price movements or targets, and time frame predictions.

A simple way to think about the difference between the two content creators is that bloggers use academic theory for analysis, while the market participants use experience and expertise that can only be gained by being a practitioner. Here are a few examples.

In May 2019, I wrote about the need for interest rate cuts and quantitative easing, while also explaining the impact of the overlap with the Bitcoin halving:

“It looks like central banks are going to be forced to make hard decisions in the first half of next year, which will coincide with Bitcoin’s block reward being cut in half. As a reminder, the block reward is the amount of Bitcoin that is distributed to the network’s miners approximately every 10 minutes.

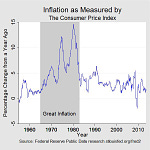

The potential scenario is that interest rates will get slashed, fiat printing will explode, and Bitcoin will get more scarce all around the same time — this is like taking a forest fire and accidentally dropping thousands of gallons of gasoline on it, instead of dropping water. Whoops!

While I believe strongly in Bitcoin’s future prospects, it would be intellectually dishonest if I didn’t mention that the scenario that I’m laying out would be incredibly painful. Average Americans (and people around the world) would get hurt by the ramifications of this type of market scenario. Hopefully it won’t come to fruition, but unfortunately I don’t think we have anyone awake at the wheel to stop it.”

In July 2019, I wrote again about the relationship between the macro environment and the Bitcoin halving:

“That means that the monetary stimulus impact will hit within 90 days of the 50% reduction in the Bitcoin monetary supply schedule. Think about that for a minute. We are going to see traditional assets being artificially pumped at the exact same time that the stock-to-flow ratio of Bitcoin becomes drastically more attractive. Incredible.

Now don’t anticipate Bitcoin’s price to see an immediate increase that causes price charts to look like they are going vertical. Instead, it will take time for the confluence of events to reveal itself in price. Regardless of the timing, Bitcoin’s value proposition is about to become painfully obvious to the world.”

And finally, on March 12th of this year I wrote about the monetary stimulus and the incoming Bitcoin halving:

“The interest rate cuts and quantitative easing is market manipulation. They are trying to bail out the economy. When they do this, investors have historically weathered the liquidity crisis and then sought out (a) sound money and (b) safe haven assets. Both gold and Bitcoin should do incredibly well during this time period.

But Bitcoin has one other other aspect to it than gold — the upcoming supply shock (Bitcoin halving in May 2020). Right when Bitcoin is about to become super attractive to people because the US government / central bank begin incredible monetary stimulus efforts, the digital asset is going to see the incoming supply cut in half. One of the scarcest assets in the world is about to become even more scarce. (This would be the equivalent of investors seeking gold because of inflation, but half the gold mines in the world shutting down at the same time)”

In order to effectively manage capital in this industry, an investor needs to understand event-based movements like the Bitcoin halving, but also possess an understanding of the macro environment and a range of other inputs. This is not an academic exercise. You can’t simply pontificate on whether “the Bitcoin halving is priced in.” That type of opinion-based, single-issue content lacks the intellectual rigor necessary to be successful in the arena of financial markets.

So as you would expect, the bloggers who were claiming the Bitcoin halving was priced in were wrong. On May 9th through May 12th, the Bitcoin price ranged between $9,600 and $8,800. Today it sits at almost $11,200. There will be people who yell and scream that the price increase had nothing to do with the halving, but it would be intellectually dishonest to believe that a supply shock of this magnitude would have zero impact on the price of such a small market cap asset.

My point in writing this letter today is to highlight two things — first, be very careful the content you consume. Journalists are an incredibly important staple of American democracy. They hold people accountable and they focus on reporting the facts. Market participants have a deep belief in what they are saying because they are willing to stake millions of dollars on those opinions. The same cannot be said about bloggers — these individuals make a living by driving attention to their publications, but they have no repercussions for when they are wrong.

Want to identify the sources of content that you should consume? Ask yourself two questions — is this person writing an unbiased piece that contains facts and commentary from an array of experts? If yes, then that is a good source. If no, then ask yourself, “Does this person have skin in the game for what they are saying?” If yes, then that is a good source.

Unfortunately, if you answer no to both of those questions, you will be better off moving on. Remember, you focus on your food diet. What you put in your body ends up determining how physically healthy you are. Your content diet is not much different. What you put into your head ends up determining how mentally healthy and financially wealthy you are. Proceed accordingly.

-Pomp

This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 50,000 other investors today.

THE RUNDOWN:

Microsoft Confirms Talks to Buy TikTok in U.S: Microsoft on Sunday confirmed that it has held talks with Chinese technology company ByteDance to acquire its trendy social app TikTok in the U.S. Microsoft said in a statement that it will keep working with the U.S. government on a deal and that it intends to conclude talks by September 15.Read more.

Bank of Japan Puts Top Economist in Charge of Digital Yen Initiative: The Bank of Japan has moved its most senior economist to lead the department responsible for research and development into central bank digital currencies. Kazushige Kamiyama, formerly director-general of the BoJ's Research and Statistics Department, has moved to the Payments and Settlements Systems Department, Reuters reported Friday. Read more.

White House, Dems Still Agree on $1,200 Checks But Deadlocked on Unemployment Assistance: While the White House has come out in favor of reducing the federal assistance to $200 a week, Democrats have called for keeping it at the $600 level. During an interview on ABC’s “This Week” on Sunday, Pelosi said that Trump was standing in the way of an agreement. “We’ve been for the $600. They have a $200 proposal, which does not meet the needs of America’s working families, and it’s a condescension, quite frankly,” Pelosi said. Read more.

SpaceX Says Starlink Internet Has ‘Extraordinary Demand:’ SpaceX said Starlink, its nascent satellite internet service, has already seen “extraordinary demand” from potential customers, with “nearly 700,000 individuals” across the United States indicating they are interested in the company’s coming service. Due to the greater-than-expected interest, SpaceX filed a request with the Federal Communications Commission on Friday — asking to increase the number of authorized user terminals to 5 million from 1 million. Read more.

Bitcoin Ends July at Highest Monthly Close Since 2017 Peak: Bitcoin closed the month of July at $11,351, its highest monthly close since the bellwether cryptocurrency’s all-time high nearly two-and-a-half years ago. Prior to this month, Bitcoin had closed below $11,000 every month since nearly reaching $20,000 in December 2017. Bitcoin futures on CME closed July at $11,620. Read more.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Congressman Tom Emmer has served the people of Minnesota as their elected official in the US House of Representatives since 2015. He also currently sits on the House Financial Services Committee and is one of the leading voices for blockchain technology in the US government.

In this conversation, Congressman Emmer and I discuss:

Wealth vs debt

Sound money

The Federal Reserve

Issues with centralization

The current economic situation

A digital dollar

The stimulus bills

Technology trends

Bitcoin

I really enjoyed this conversation with Congressman Emmer. Hopefully you enjoy it too.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

We have started a new show exclusive to YouTube called Lunch Money. The goal is to cover current events in business, finance, and technology from the perspective of the every day citizen, rather than the talking heads on television. It is just as funny and entertaining as it is educational. Hope you enjoy it and make sure you go subscribe to the YouTube channel!

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Choice is a new self-directed IRA product that allows you to buy Bitcoin with tax-advantaged dollars, while still holding your private keys. You can go to retirewithchoice.com/pomp to sign up today.

Helium Hotspots allow you to earn cryptocurrency by building a new wireless network for the Internet of Things and creating a more connected future in your city. Get $50 off your Helium Hotspot by going to helium.com and using my special code POMP at checkout.

Unstoppable Domains is working to make the internet operate how it was originally intended, which means anyone can publish anything from anywhere. You can go to unstoppabledomains.com and claim your censorship resistant domain today.

BlockFi allows you to keep your crypto, put it up as collateral, and receive a USD loan funded directly to your bank account. They do loans ranging from $2,000 to $10,000,000, and they're perfect for helping you reach your financial goals of all sizes. Visit BlockFi.com/Pomp to learn more about putting your crypto to work without having to sell it by getting a loan or earning interest in their interest bearing accounts.

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp2020” when you sign up for one of their metal cards today.

Blockset by BRD is your hosted blockchain infrastructure. Blockset enables enterprises and developers around the globe to deliver high-quality blockchain-based applications in a fraction of the time, at a fraction of the cost.

WSOT is the biggest trading competition in the crypto space, with a massive 200 BTC prize pool and bonuses of 9,400 USDT up for grabs!

If you enjoy reading “The Pomp Letter,” click here to tweet to tell others about it.

Nothing in this email is intended to serve as financial advice. Do your own research.

Why The Financial Media Got The Bitcoin Halving Wrong & How Bloggers Are Infiltrating These Organizations